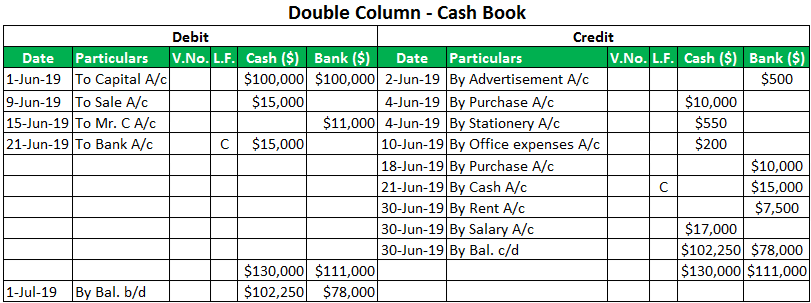

Receiving interest from depositing money into a business bank account would result in a debit for the cash received with an accompanying credit for finance income, which would mean an increase in income.Purchasing a piece of equipment with cash would show a debit for the equipment and a credit for the cash, which results in a decrease in assets.To illustrate what this theory means as part of real-world accounting, here are some examples of how it is applied:

This principle means that, even though a company is spending cash out of their accounts, they are gaining something in return, such as the ad, or something else (e.g. In each of these components, the overall idea is that every transaction results in two effects that must be accounted for, which is also known as the Duality Principle. The expense of the ad-a liability-led to a decrease in owner’s equity through the disbursement of cash to pay for the ad.Īnother component of the double-entry concept is that amounts that are entered as debits must equal those added as credits within general ledger accounts. Let’s look at the equation in the context of the aforementioned print ad example. I like to call this “the financial compliance” equation. The main idea is to always keep a balance, so the double entry bookkeeping system can use what is known as the accounting equation. Similarly, if a company purchases a print ad, its cash account decreases while its expense account, under the account category of advertising expense, increases.

If a company takes out a loan, for example, its cash account will increase with the funds from that loan, but its liability account will also increase under the account category, known as loans payable. The Theory Behind Double-Entry BookkeepingĪt the core of double-entry bookkeeping is the concept that every transaction will involve at least two accounts, if not more.

0 kommentar(er)

0 kommentar(er)